So far in 2023, the local real estate market could be summed up in one simple word: weird. That's right, it's been a weird year! It's certainly different than the few previous years which may have been described by a different "w" word: wild. It would be hard to deny that things have calmed down a little bit. That means that there's good and bad news, depending on who you are. But for many, this market may feel like a bit of a return to normal. While that may be true for some, it's not true for all. That's where things get weird. . .

For some home sellers their homes are sitting on the market for long stretches and they're doing price drops. For others, they're coming on and getting multiple offers straight away, and often accepting one in excess of asking price. Some home buyers continue to struggle to find the right place amid low inventory and rising values and rates. Others have used this year as an opportunity to find the success that eluded them these past 1-2 years. Fewer buyers means fewer offers in multi-offer scenarios. While multiple offer situations aren't as common as in years past, they're not gone entirely.

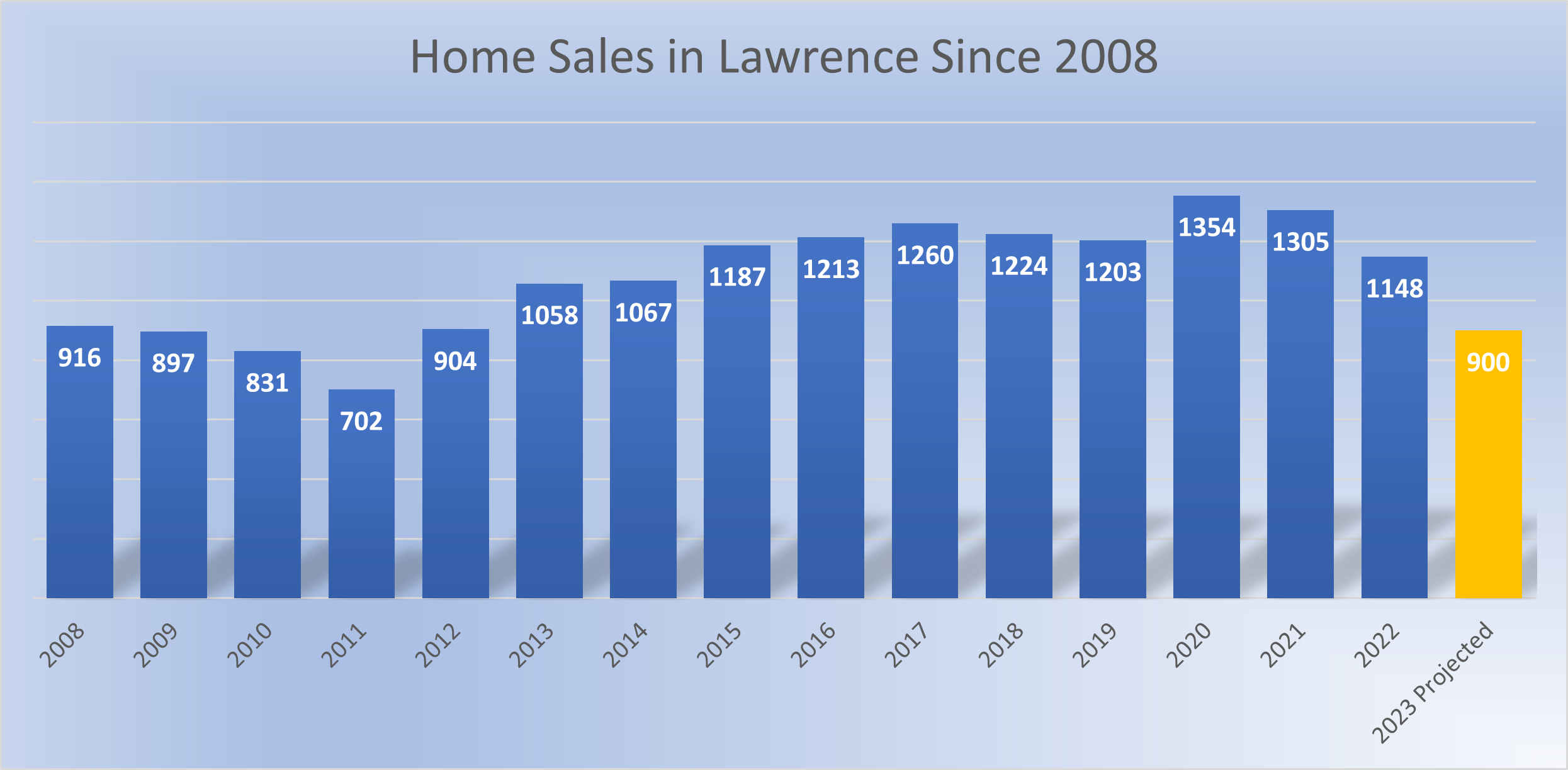

But the bad news is that new listings and home sales inside Lawrence are WAY down. New listings and home sales are down almost 23% for the first half of the year. At this rate, Lawrence is on pace to sell 900 or fewer homes by year's end. To put that in perspective, they last year that happened was 2011, when we were mired in the after-effects of the Great Recession. Here's a graph looking at home sales history in the city of Lawrence going back to 2008:

As shown above, starting in 2012 we began a climb out of the hole in sales left by the Recession. That climb mostly continued through the sales peak of 2020 where there were over 1,300 sales in town. Tight inventory has led to a decline since that peak. That trend has been hyper-inflated in 2023 due to a number of factors, but in my opinion has a lot to do with rising interest rates. As I'll show below, rates have been low for a long time. In fact, they had been kept artificially low for far too long. Many home owners bought a new home or refinanced during that time. Now that rates are over 7.0%, those homeowners aren't' going anywhere. If the second half of 2023 turns out to be a cool market in sales, then Lawrence is likely to post fewer than 900 sales for the first time since 2011!

As shown above, starting in 2012 we began a climb out of the hole in sales left by the Recession. That climb mostly continued through the sales peak of 2020 where there were over 1,300 sales in town. Tight inventory has led to a decline since that peak. That trend has been hyper-inflated in 2023 due to a number of factors, but in my opinion has a lot to do with rising interest rates. As I'll show below, rates have been low for a long time. In fact, they had been kept artificially low for far too long. Many home owners bought a new home or refinanced during that time. Now that rates are over 7.0%, those homeowners aren't' going anywhere. If the second half of 2023 turns out to be a cool market in sales, then Lawrence is likely to post fewer than 900 sales for the first time since 2011!

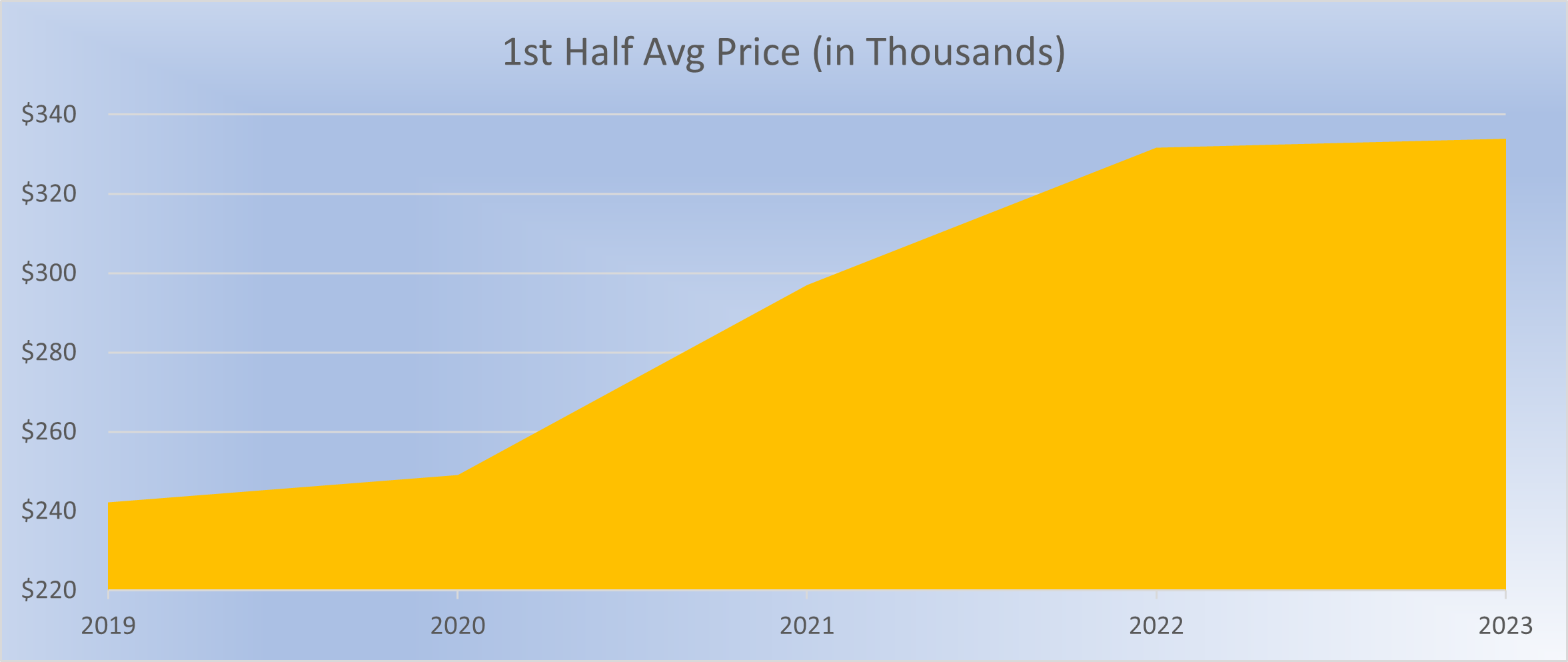

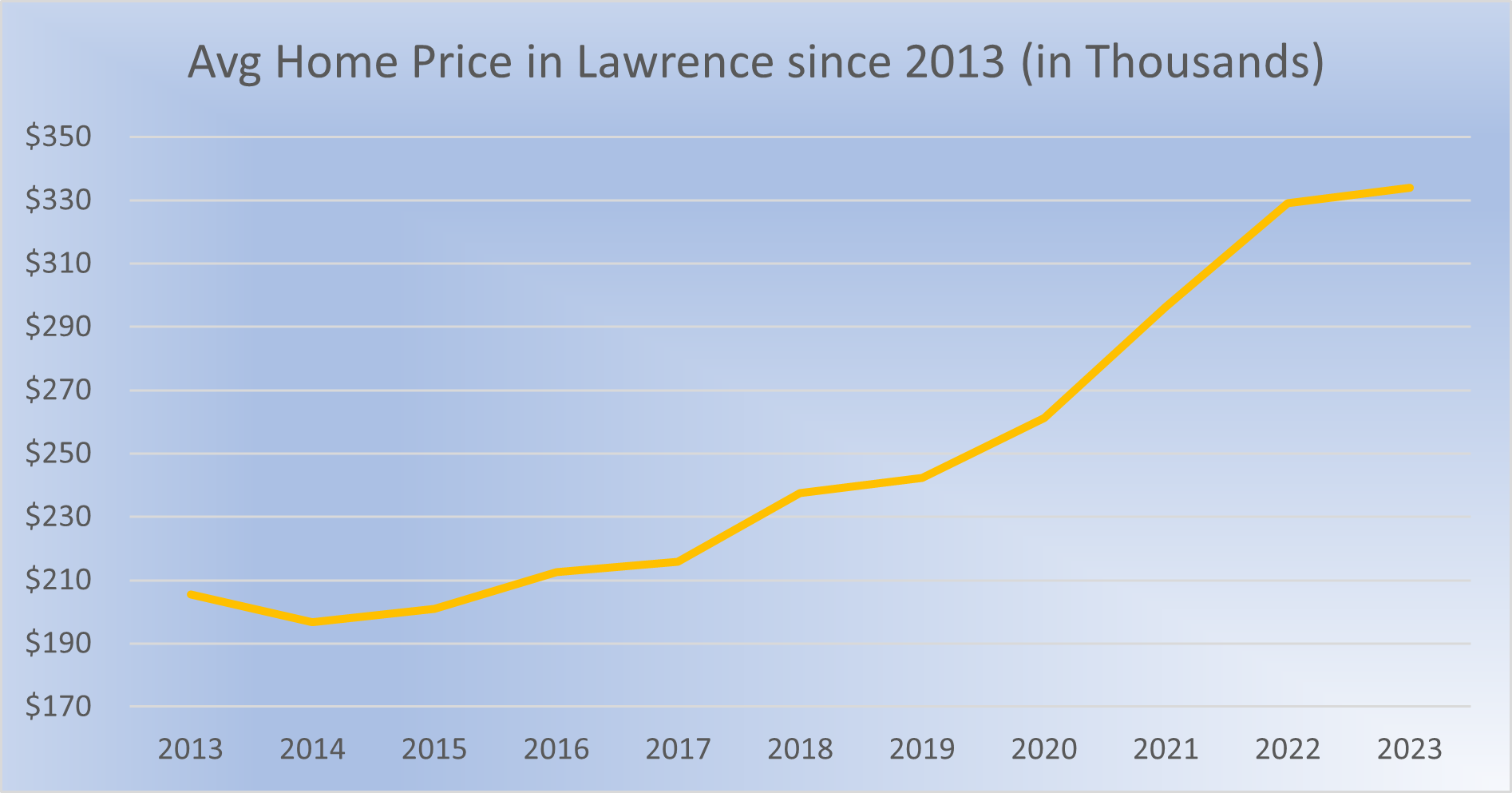

Taking a look at prices through the 1st half of 2023 is a much more sobering picture than the previous few years. Since the start of the Pandemic, home prices went into a pressure cooker. But as the following graph will show, this year they're beginning to cool off:

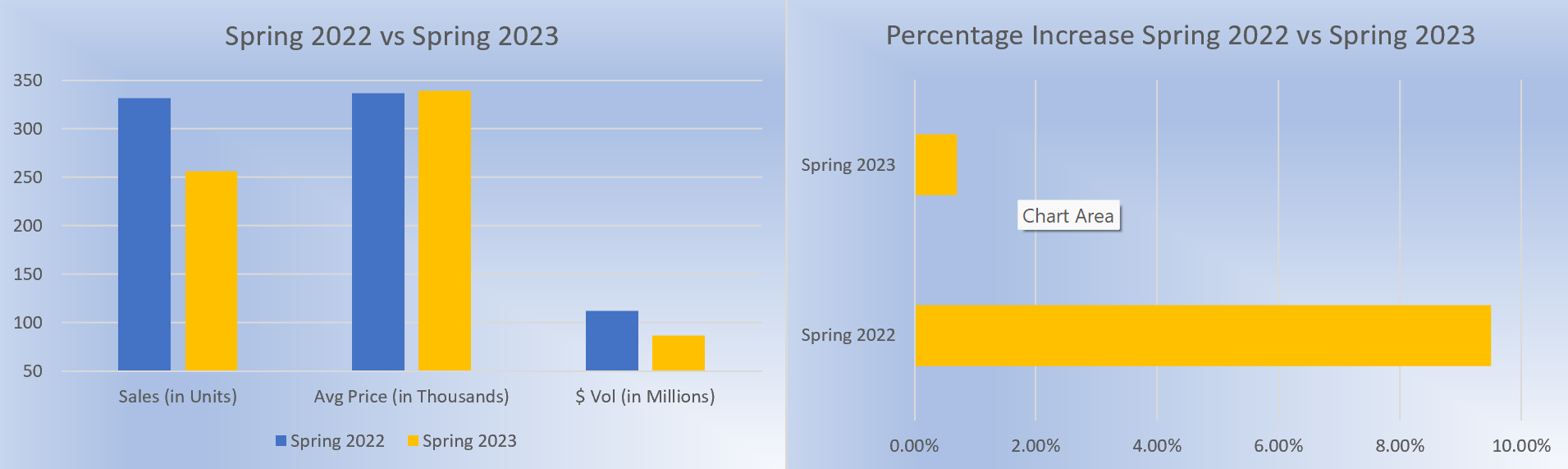

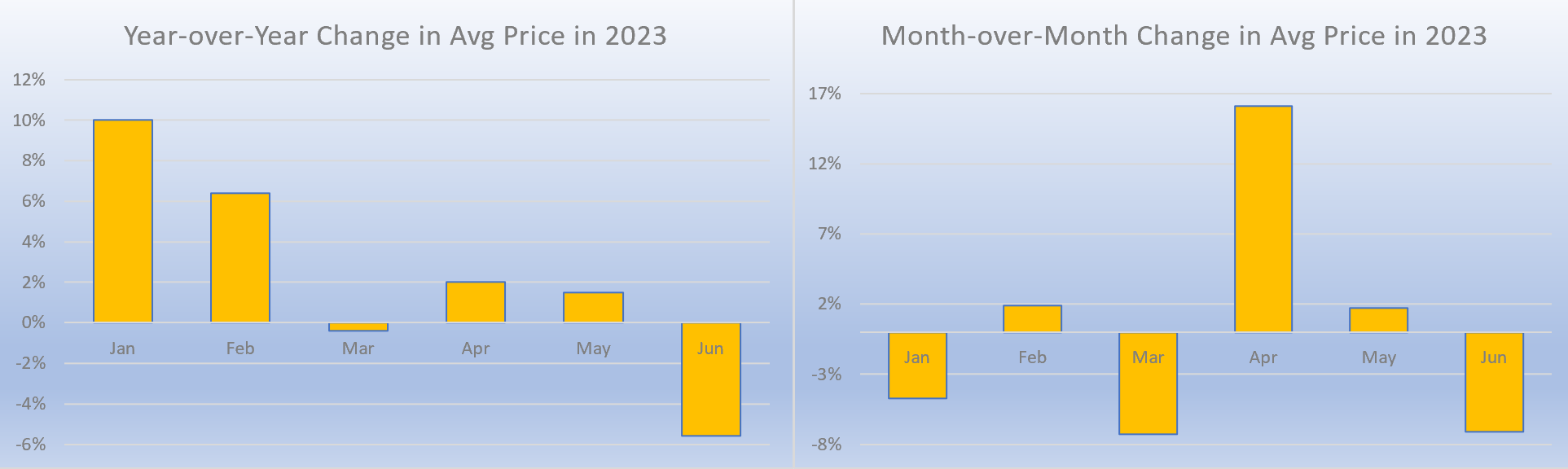

Looking at average price another way is to compare this Spring with last Spring. While the highest average price ever recorded was in May 2023, the increases seen this year aren't as large as seen in previous years. And with a huge decline in sales, the total dollar volume of the market had seen a massive drop. What's important to note here is despite the drop in sales, prices did increase in the 1st Half. Referring the graph on the right, they just increased much more modestly than the previous Spring.

Looking at average price another way is to compare this Spring with last Spring. While the highest average price ever recorded was in May 2023, the increases seen this year aren't as large as seen in previous years. And with a huge decline in sales, the total dollar volume of the market had seen a massive drop. What's important to note here is despite the drop in sales, prices did increase in the 1st Half. Referring the graph on the right, they just increased much more modestly than the previous Spring.

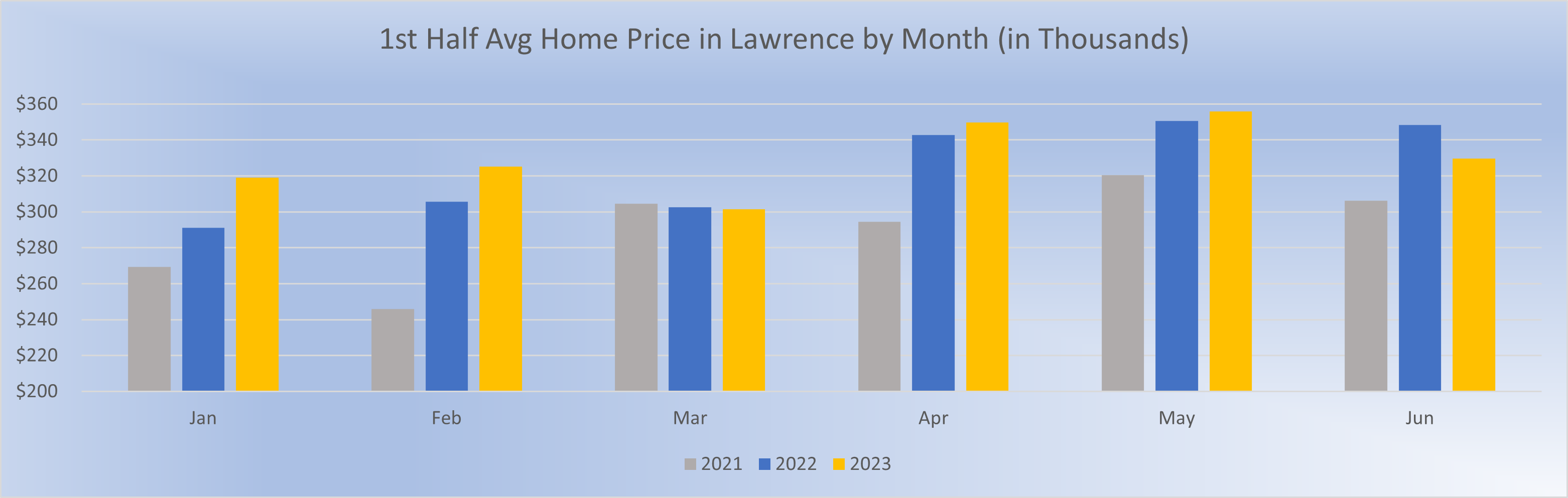

Another way to look at average price in Lawrence is put it into a little longer historical context. The following graph takes a look at average price by month for each of the past 3 years.

As I previously mentioned, the record for highest average price in a month was seen in May this year at an astounding $355.8K! But that mark was not held for long. June 2023 gave the year's 1st Half a pretty soft landing with an average price falling back down to $329.7K. This figure also represents a pretty steep decline from June of the previous year. The next image is a look at each month in the 1st Half:

As I previously mentioned, the record for highest average price in a month was seen in May this year at an astounding $355.8K! But that mark was not held for long. June 2023 gave the year's 1st Half a pretty soft landing with an average price falling back down to $329.7K. This figure also represents a pretty steep decline from June of the previous year. The next image is a look at each month in the 1st Half:

2023 looks to be pretty much all over the place. The year actually got off to a decent start compared to the beginning of 2022, posting 10% increase YoY. But that's where things get weird. One month is down the next is up. March saw price declines, which is pretty unusual for the first month of Spring. April did well to correct a soft March, and May performed about as expected. But right there at the the end is that previously mentioned soft month of June. Is June's mild performance the start of a trend for the year's 2nd Half? Only time will tell!

2023 looks to be pretty much all over the place. The year actually got off to a decent start compared to the beginning of 2022, posting 10% increase YoY. But that's where things get weird. One month is down the next is up. March saw price declines, which is pretty unusual for the first month of Spring. April did well to correct a soft March, and May performed about as expected. But right there at the the end is that previously mentioned soft month of June. Is June's mild performance the start of a trend for the year's 2nd Half? Only time will tell!

That's probably a good segue into looking at some more historical context. Like sales, average home prices in Lawrence have been on an upward trend since the end of the Great Recession. By the start of the Pandemic, things went into overdrive! That trend has been the stuff of headlines for much of the past 3 years. But with a glance at the graph's right side, it's clear that there's change afoot yet again.

It's hard to believe that just 4 years ago in 2019 the average home price in Lawrence was a mere $242.2K. It seems like a lifetime ago! In 2021 the average home price blew past $300K. Don't expect that figure to ever drop back below that mark. But the 2022-23 portion of the graph certainly does not indicate the same price increases seen since 2019. And to be quite honest, that's probably a good thing. From 2019 to 2022 the above graph looks logarithmic. That kind of growth probably isn't sustainable over the long-haul. In fact, if it kept going I think we'd have to start talking about a "bubble" and if or when it might burst. As many of my previous market updates can attest, I've resisted referring to the accelerating market climate as a "bubble." And rightfully so. The increases in price seen these past few years have been driven largely by supply & demand, not by speculation and free money. But it remains to be seen what the current economic climate does to home sales in the near future. For now, resist any headlines that try to doom-say about some massive correction coming to the housing market. There's literally no indication that this is on the way anytime soon!

It's hard to believe that just 4 years ago in 2019 the average home price in Lawrence was a mere $242.2K. It seems like a lifetime ago! In 2021 the average home price blew past $300K. Don't expect that figure to ever drop back below that mark. But the 2022-23 portion of the graph certainly does not indicate the same price increases seen since 2019. And to be quite honest, that's probably a good thing. From 2019 to 2022 the above graph looks logarithmic. That kind of growth probably isn't sustainable over the long-haul. In fact, if it kept going I think we'd have to start talking about a "bubble" and if or when it might burst. As many of my previous market updates can attest, I've resisted referring to the accelerating market climate as a "bubble." And rightfully so. The increases in price seen these past few years have been driven largely by supply & demand, not by speculation and free money. But it remains to be seen what the current economic climate does to home sales in the near future. For now, resist any headlines that try to doom-say about some massive correction coming to the housing market. There's literally no indication that this is on the way anytime soon!

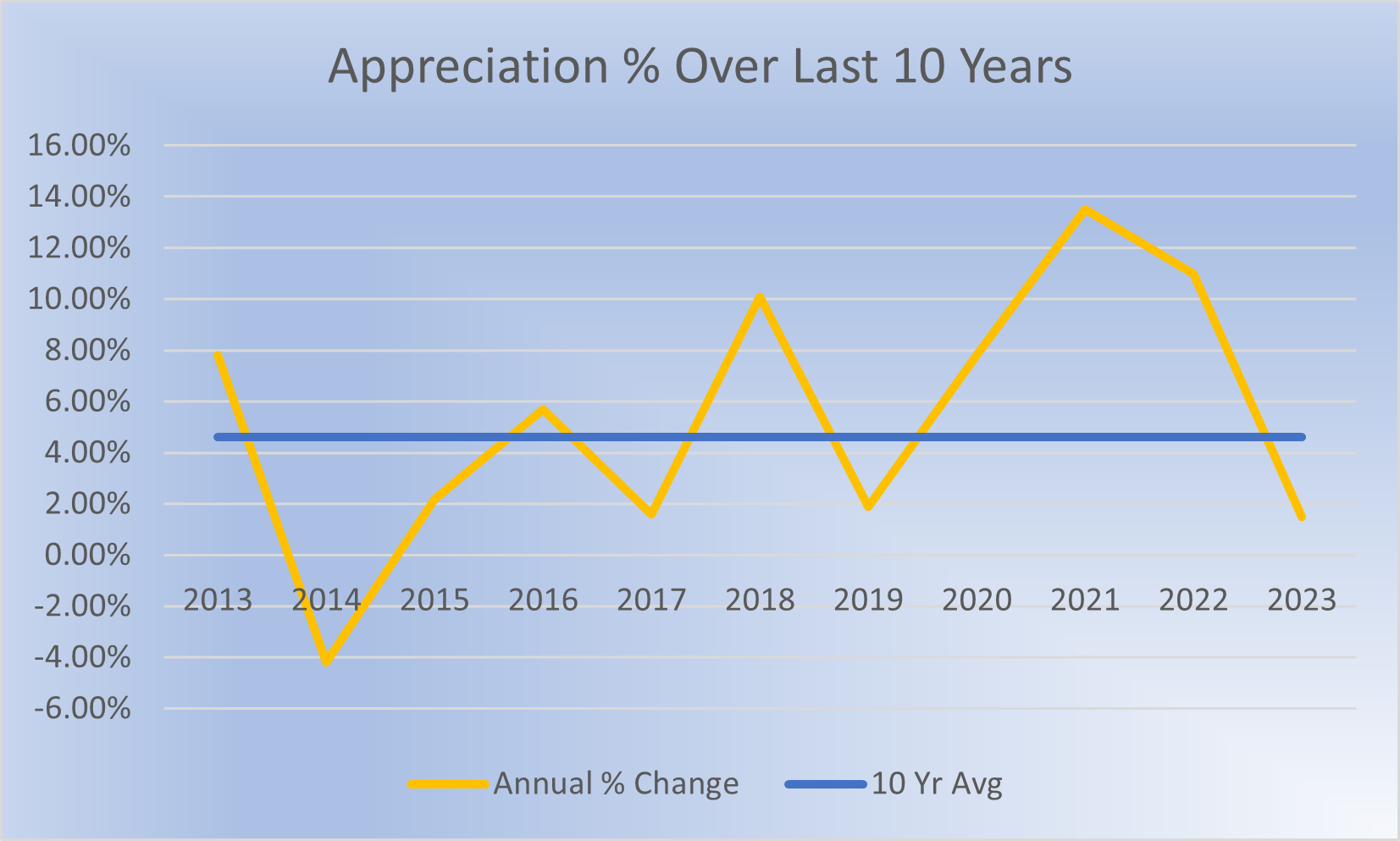

With all this talk of rising prices, it's a good chance to see how appreciation has played out these past 10 years. The above graph compares the annual appreciation rates with the 10 year average going back to 2013. I think the things to point out here are how high above the average appreciation was from 2020 through 2022, and how 2023's market has brought us back below that average. Keep in mind however, that figure for 2023 is still positive. Our market hasn't seen negative appreciation since a blip in 2014. I doubt we see it anytime soon, but it's not out of the question. If the 2nd Half of 2023 turns out softer than expected, it's not impossible we could actually see price declining overall for the year. Right now we're sitting at 1.9% over last year. With 6 months to go, that's a slim margin!

With all this talk of rising prices, it's a good chance to see how appreciation has played out these past 10 years. The above graph compares the annual appreciation rates with the 10 year average going back to 2013. I think the things to point out here are how high above the average appreciation was from 2020 through 2022, and how 2023's market has brought us back below that average. Keep in mind however, that figure for 2023 is still positive. Our market hasn't seen negative appreciation since a blip in 2014. I doubt we see it anytime soon, but it's not out of the question. If the 2nd Half of 2023 turns out softer than expected, it's not impossible we could actually see price declining overall for the year. Right now we're sitting at 1.9% over last year. With 6 months to go, that's a slim margin!

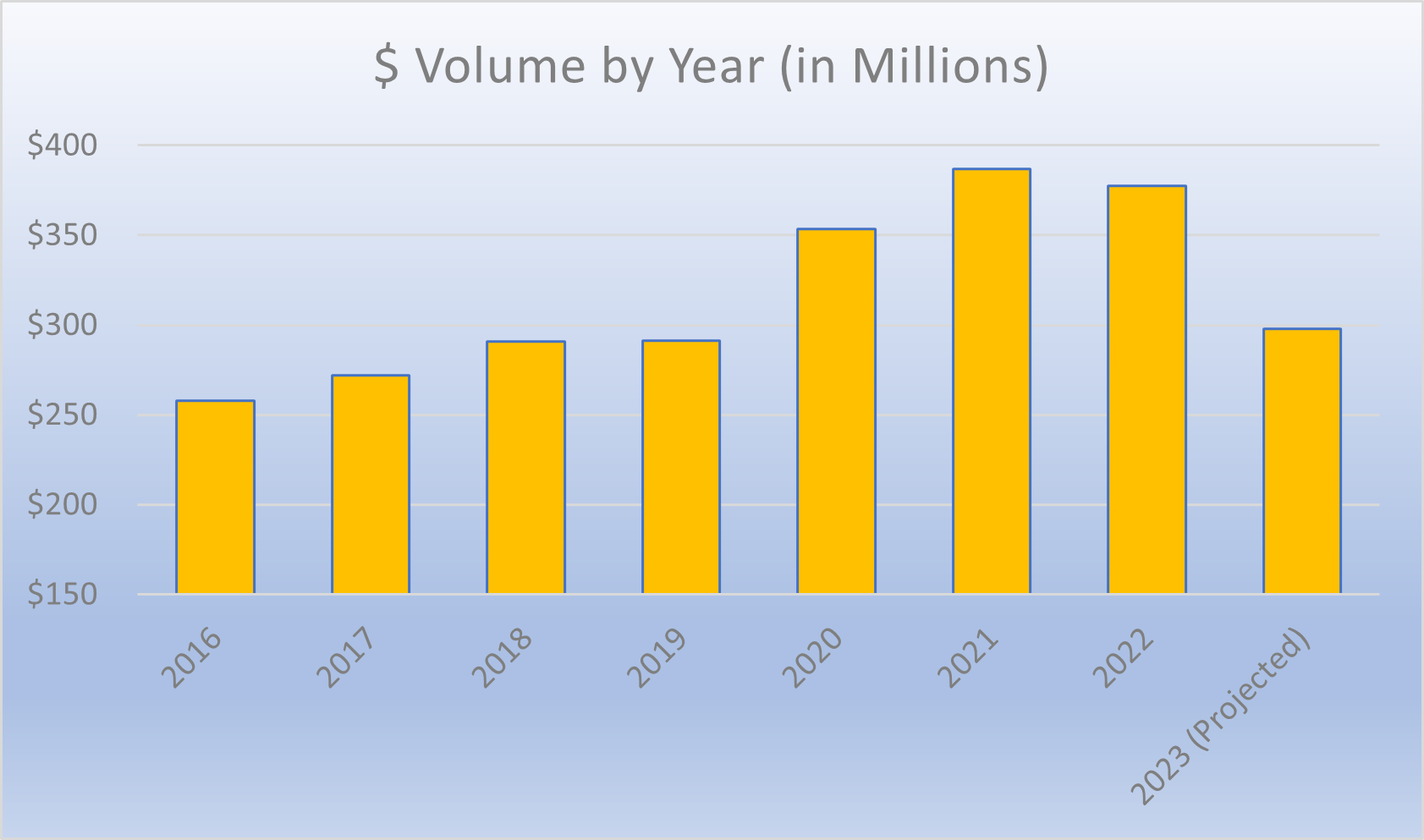

Talk of average prices and appreciation is a nice lead into market dollar volume. This metric may be less interesting to the public than to Realtors, but I do like the historical context the above graph provides. With falling sales and flat appreciation, there's much less sales volume in the marketplace this year. As the market volume contracts, competition among agents increases. There's far fewer dollars to go around for real estate commissions this year than in the previous few years. For any part-time and hobby agents out there looking for a way out of the business, this is the chance to get off the boat. For those that don't want to get off the boat, this market just might force them out. This author is of the opinion that are far too many real estate agents out there. Only about 25% or so do enough transactions to make a true living. Just like the Great Recession that saw huge drops in MLS memberships, if the current climate continues we should see the same in the next couple years. In fact I believe it's already happening!

Talk of average prices and appreciation is a nice lead into market dollar volume. This metric may be less interesting to the public than to Realtors, but I do like the historical context the above graph provides. With falling sales and flat appreciation, there's much less sales volume in the marketplace this year. As the market volume contracts, competition among agents increases. There's far fewer dollars to go around for real estate commissions this year than in the previous few years. For any part-time and hobby agents out there looking for a way out of the business, this is the chance to get off the boat. For those that don't want to get off the boat, this market just might force them out. This author is of the opinion that are far too many real estate agents out there. Only about 25% or so do enough transactions to make a true living. Just like the Great Recession that saw huge drops in MLS memberships, if the current climate continues we should see the same in the next couple years. In fact I believe it's already happening!

A Word on Rates

Rates are NOT helping us. Not buyers, not sellers, not anyone. It is this author's opinion that the Fed's raising of interest rates has already overshot the mark and continued raising of rates will have a massively negative impact on home affordability that has already seen the pressures of rising prices and competition in recent times. The fact of the matter is that they kept rates artificially low for far too long. And then they not only raised them too quickly, they also raised them too high. Throw in some raging inflation and you've got a recipe for disaster.

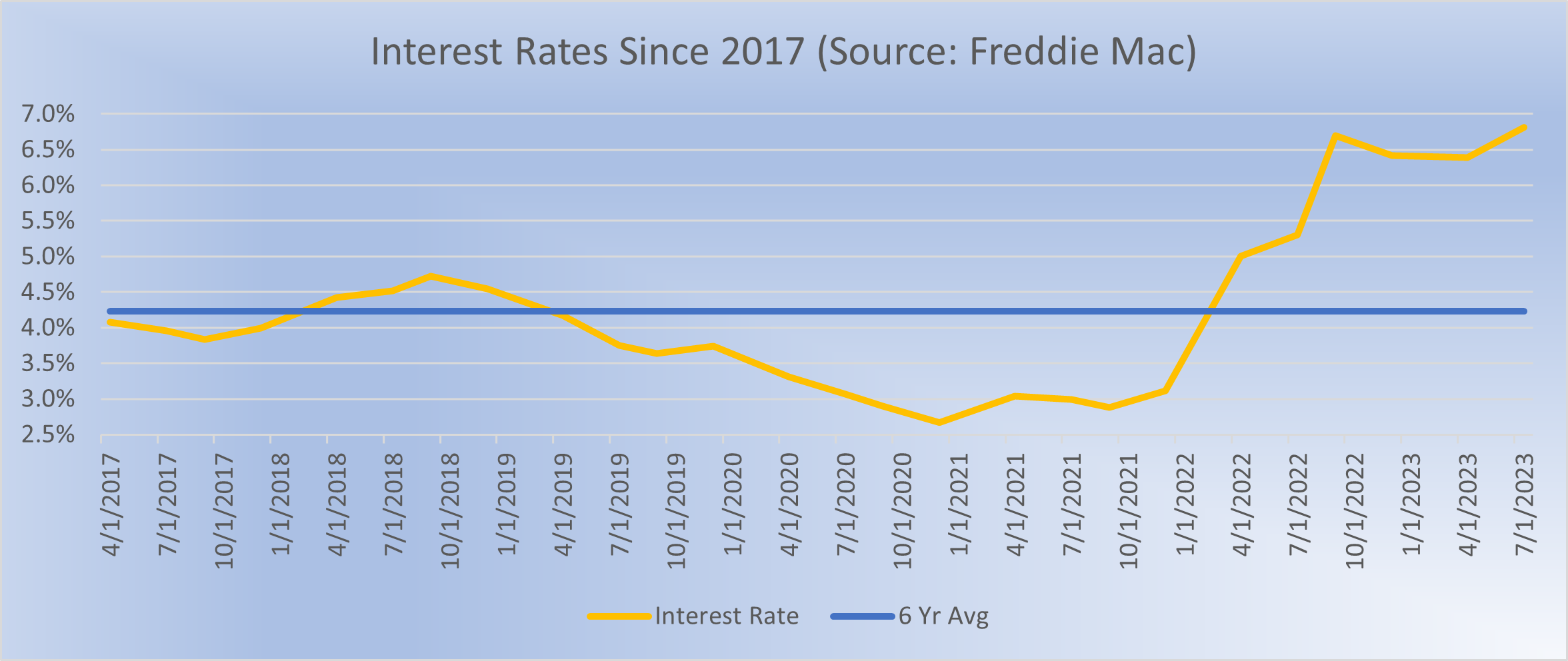

The above graph shows rates going back to 2017. The average rate over that time is around 4.2%. Prior to 2022, the average was closer to 3.5%. As of this writing, I'm seeing a lot of rates north of 7.0% and that's largely for well-qualified buyers. Rates have literally doubled! This environment has taken many buyers out of the market. They simply can't afford the higher rates along with the rise in values. This has been one of the main drivers of the relative cooling in the market. While multiple offer situations are still common, there usually fewer offers these days. Think 2 or 3 offers instead of twelve. But long story short, rates need to come down. The good news is I believe most lenders and forecasters are saying they should come down by year's end, or early next year. Let's just say they better be right!

The above graph shows rates going back to 2017. The average rate over that time is around 4.2%. Prior to 2022, the average was closer to 3.5%. As of this writing, I'm seeing a lot of rates north of 7.0% and that's largely for well-qualified buyers. Rates have literally doubled! This environment has taken many buyers out of the market. They simply can't afford the higher rates along with the rise in values. This has been one of the main drivers of the relative cooling in the market. While multiple offer situations are still common, there usually fewer offers these days. Think 2 or 3 offers instead of twelve. But long story short, rates need to come down. The good news is I believe most lenders and forecasters are saying they should come down by year's end, or early next year. Let's just say they better be right!

So where does all this take us into the 2nd Half of 2023? I do have some predictions and those predictions echo those I made in January. Back then I predicted there would be fewer than 1,000 homes sold inside Lawrence this year. At the current rate it could be below 900! Do I think this will happen? Right now I'm inclined to say yes, the Lawrence housing market will post fewer than 900 sales this year. But I'm not making this prediction with as much confidence as the prediction of below 1,000. That is a near certainty at this stage!

I also predicted that prices would continue to rise, albeit at a much lower clip than the previous years. This also seems to bear out so far, with appreciation at a much more modest 1.9%. Will it continue and will we end the year with a slight increase in average price? Again, I believe this will happen. But this margin is also extremely slim. One bad month could skew the numbers downward into negative territory. However I'm predicting very mild to modest increases to hold by New Year's Eve. The main reason I believe this is last Fall saw interest rates rising fast and it froze the market. This year the rates are already high and shouldn't keep going up too much. If they stay put, we should see positive appreciation in Lawrence.

If you're a buyer in this market, I actually think there's lots of good news above. Outside of interest rates, that is. There's less competition than previously, and that alone may be enough to tip the scales in their favor. But there's no fooling around. Don't think that you're going to go in and get a steal, there are few to be found. Homes are going at what their value is. No one's giving anything away. Smart home buyers are acting quick and they have their ducks-in-a-row. And if they're finding success, it's partly because they're listening to their agent. If you can swallow the rate (plan to refi in the future) now's the time to buy. Don't wait for prices to go down. By the time your wait is over they'll be up and you'll be kicking yourself for not buying sooner!

For home sellers, there's little doom-and-gloom. In fact, if you're a seller that needs to buy, it's probably an opportunity that hasn't felt open for years! And while prices continue to increase, the increases in 2023 probably represent a more healthy market than a pressure cooker market. Prices have risen so much these past years that it's hard to go wrong. It's still a great time to sell, and that reality shouldn't change anytime soon.

Thanks for reading and keep coming back for all our monthly market updates as we head through the remainder of the year!

*All stats except Interest Rates are sourced from the Lawrence MLS

-Ryan Desch, Broker/Owner/Realtor